- #Cogs vs operating expenses how to

- #Cogs vs operating expenses software

- #Cogs vs operating expenses free

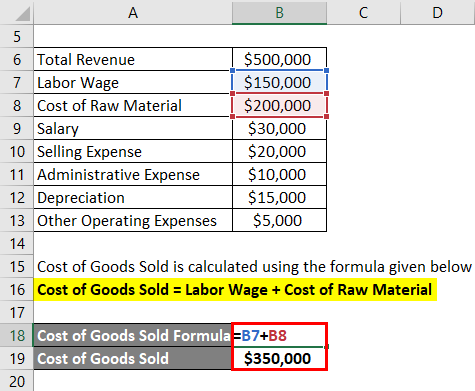

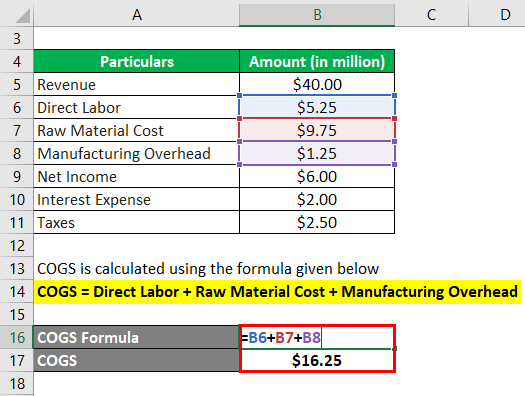

The cost of goods sold (COGS) refers to the costs that a business incurs to produce its goods or services. Operating expenses are only one part of your total operating costs. Examples of operating expenses are rent, payroll and benefits, inventory, banking fees, marketing ads, business licenses, and transportation.Īlthough you may see “operating cost” and “operating expense” used interchangeably in other articles, there is a difference. They’re also called Selling, General, and Administrative (SG&A) expenses. Operating expenses (OPEX) are the costs a business incurs to stay up and running. If the operating cost definition seems broad, you can break these costs down into two slightly neater categories: operating expenses and cost of goods sold. With this data in hand, you can better identify the sources of profits or losses, discover opportunities to optimize spending, and gain control over your financial health. Once you’ve tallied up your total operating costs, you’ll list it on your income statement for you, your investors, and shareholders to analyze.

#Cogs vs operating expenses free

Keeping your operating costs down is one of the easiest ways to improve your company’s profitability and create free cash flow. When production increases, overtime pay may increase or vary.

At your normal production levels, overtime pay may be nonexistent or fixed.

#Cogs vs operating expenses how to

We’ll cover how to use operating costs in your decision-making, as well as tips to reduce spending in some of these areas. This article defines operating costs and explains what generally is and isn’t included in this number.

In other words, you need to calculate your operating costs periodically, and definitely before you start your business. Without an accurate estimate of the funds needed to keep the lights on, success and sustainability are a long shot. That said, all companies need to know exactly how much money it takes to maintain operations and generate revenue. The nature of your spending-and what qualifies as important-will ultimately depend on your company’s product or service.

#Cogs vs operating expenses software

From advertising software to the espresso fueling your next meeting, every business expense has an important part to play.

0 kommentar(er)

0 kommentar(er)